The Binance Coin price, after what has been undeniably a stellar quarter, is steady, slightly lower versus the greenback but posting gains against both BTC and ETH. Presently, the path of least resistance, especially from a top-down review, is bullish.

As of writing on Mar 22, the BNB price is up roughly two percent against the USD and steady versus ETH and BTC. However, year-to-date, the BNB is up an impressive 21X, trading at $266 and perched at third in the market cap leaderboard.

While the uptrend is firm, participation has been tapering in the last week of trading. For instance, the BNB average trading volumes of the previous day of trading are down 21 percent. At this level, $1.26 billion worth of BNB changed hands across exchanges.

Albeit the shrinkage, buyers are still in control. Besides, liquidity, despite the contraction, doesn’t affect BNB’s liquidity.

Binance Coin Price Overview

The BNB/USD price remains in consolidation, reflecting the minor gains of the past week of trading against major currencies. However, while trading volumes are comparatively lower, BNB bulls are in the driving seat.

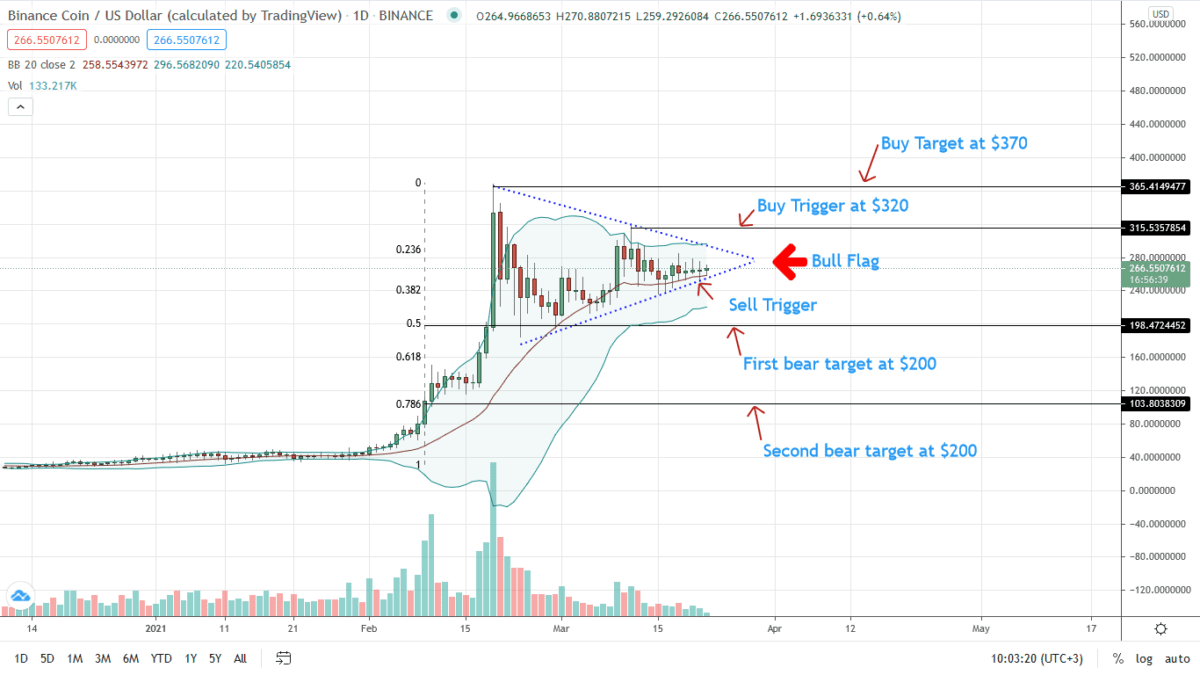

From the daily chart, the immediate support is the middle BB—a flexible line representing a buy wall, and Mar 4 low at around $230. Notably, the BNB price, for the better part of the last two weeks, has been consolidating within a $90 zone.

On the upper end, bulls are waiting for signals. In that case, a close above $320 will thrust prices above the upper trend line of the bull flag–especially if there is a surge in trading volumes. This could catalyze participation with a high possibility of the BNB/USD price rallying back to $370—Feb 2021 highs.

However, a sharp close below $320 may see the BNB price crater back to $200—around Mar lows, without discounting the possibility of a dump to $100—the 78.6 percent Fibonacci retracement level of the Feb 2021 trade range.

Binance Coin Market Movers

aExchange—the largest exchange by client count globally, the Binance Smart Chain (BSC)—a smart contracting platform competing with Ethereum, the Binance CeFi, and other ancillary products keeping clients engaged with crypto.

The BSC continues to grow in prominence, recently processing more transactions than Ethereum.

Due to its lower on-chain fees, more DeFi projects from Ethereum are branching out to the EVM-compatible BSC.

The growth of DeFi in BSC, and the reward of participants with BNB, could see the coin’s price edge even higher. Transaction volumes on the BSC continue rising:

Binance Coin (BNB) Price Analysis

The BNB/USD price is steady versus ETH and BTC on the last day of trading.

From the daily chart, the BNB price remains in consolidation with caps at $320 and $230. In a bull trend continuation pattern, gains above $320 confirm the current consolidation as an accumulation and open up the BNB price to $370—Feb 2021 highs.

On the lower end, in a bear trend continuation pattern of late Feb 2021, the BNB prices may fall below $230 and the middle BB to $200—the first bear target coinciding with the 50 percent Fibonacci retracement level of the Feb 2021 trade range.

In the current consolidation, traders are opting to stay out until a definitive trend forms for guidance. Accordingly, a breakout in either direction may either slow down BNB bulls or fan liquidation in a correction.

Disclaimer: Opinions expressed are not investment advice. Do your research.